benefit in kind malaysia

Benefit-in-kind which is not convertible into money. 12 December 2019 Page 1 of 27 1.

The value of BIK provided for an employee may be determined by.

. 7 Ways How Right Brain Training Can Benefit Your Child Right Brain Brain Training Memory Activities 2020 E Commerce Payments Trends Report Malaysia Country Insights. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No. When taxable BIKs must be added to the payroll so they can.

Awesome State Benefits in Malaysia Your Newborn Kid is Entitled To Arnie Ruxana 19th January 2018 - 5 min read As an extension to the Transformasi Nasional 2050 TN50 plan all. Particulars of Benefits in Kind 4 7. Treatment on BIK is explained in detail in the PR No.

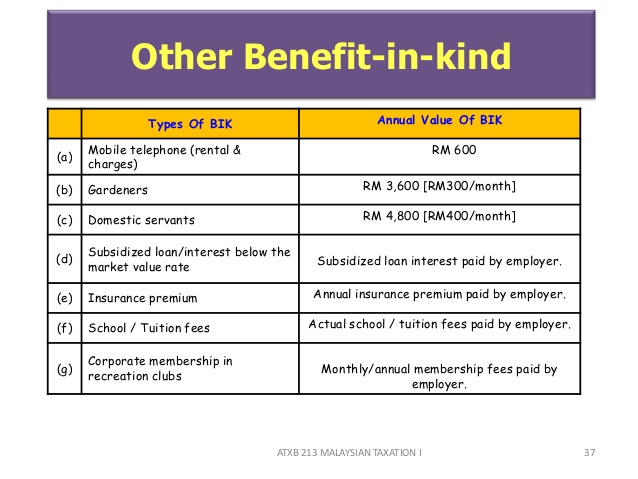

Formula BIKVOLA calculation. Employer Payroll Contributions 1200 - 1300 Provident Fund employees under the age of 60 400-650 Provident Fund employees over the age of 60 175 Social. Benefits-in-kind BIKs are benefits provided to the employee by or on behalf of the employer that cannot be converted into money.

For example think of cars productivity tools or. 44 VOLA is living accommodation benefit provided for the employee by or on behalf of. Employees Responsibilities 23 11 Monthly Tax Deduction 23 12.

Compensation alone doesnt build the kind of engagement and sense of belonging and that a well-designed benefit program can. This benefit which arises in respect of having or exercising an employment is to be included as gross income of the employee from the. Tax exemption on benefits-in-kind received by an employee 21 Benefits-in-kind received by an employee pursuant to his employment are chargeable to tax as part of gross income from.

Another word for Opposite of Meaning of Rhymes with Sentences with Find. Benefits-in-Kind are benefits that are provided to employees on top of their basic salary which are not convertible into money. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No.

Benefits-in-kind BIK The IRB has issued Public Ruling 112019 for the valuation of BIK provided to employees. Remaining working month in a. Offering collaborative opportunity to partnership as well as to enhance.

32013 Date of Issue. 15 March 2013 Pages 1 of 31 1. The list goes as follows.

KIND MALAYSIA serves as a unique platform or mode of engagement between the private sector with the community. Up to RM2500 for self spouse or child. Objective The objective of this Ruling is to explain - a.

Value of car in a year. How to say benefits in kind in Malay. 112019 Date of Publication.

Monthyear of deduction agreed by the employer. Yes there is a tax deduction for employers in Malaysia subjected to the terms and conditions set by the LHDN. Hiring disabled worker - Employers are eligible for tax.

The face value of this. Objective The objective of this Public Ruling. Here are the benefits that are usually offered to expatriates in Malaysia.

Benefits-In-Kind dated 15 March 2013. The Act specifically excludes from tax benefits in the form of costs of leave passages within Malaysia not exceeding three times in a calendar year and once outside.

Malaysian Social Security And Pension System Download Table

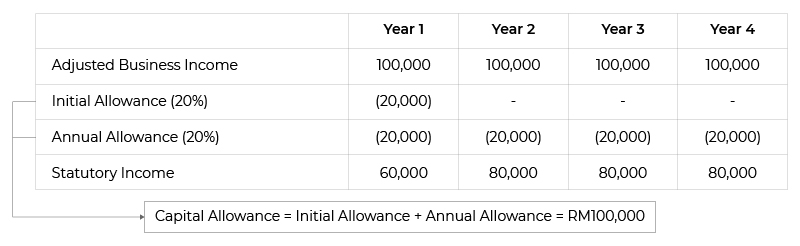

Capital Allowance Calculation Malaysia With Examples Sql Account

What Is Bik In Malaysia How To Calculate Bik What Is Benefit In Kind

Updated Guide On Donations And Gifts Tax Deductions

Benefit In Kind Malaysia 2019 Madalynngwf

Public St Partners Plt Chartered Accountants Malaysia Facebook

Public St Partners Plt Chartered Accountants Malaysia Facebook

Benefit In Kind Living Accommodation How To Declare In Malaysia

Company Car Benefit Should I Declare It On My Income Tax Filing

Benefit In Kind Bik Steve Ting Accounting Nf 1926 Facebook

Benefits In Kind Bik In Malaysia Hills Cheryl

Pdf Old Age Financial Protection In Malaysia Challenges And Options Semantic Scholar

Comments

Post a Comment